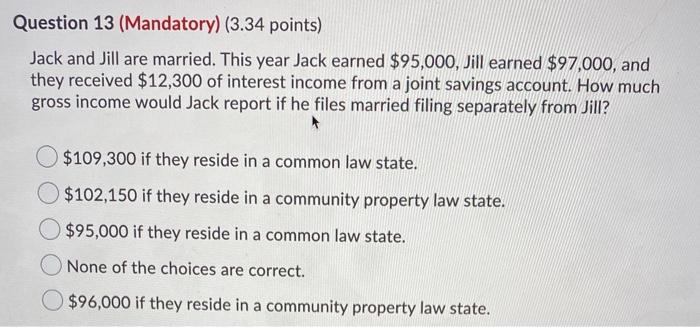

Jack and Jill Are Married. This Year Jack Earned

Jack and jill are married. Jack and Jill are married.

Jack And Jill Wedding Music Penticton Weddingwire Ca

Jack and Jill are married.

:max_bytes(150000):strip_icc()/Jack-and-jill-party-4843538_final_rev_02-6e80293f5d374aed99f069857abe107f.png)

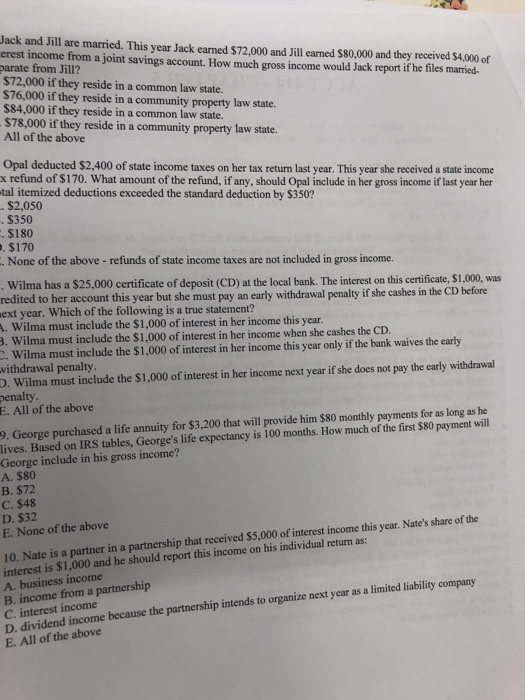

. How much gross income would Jack report if he files married filing separately from Jill. How much gross income would Jack report if he files married filing separately from Jill. This year Jack earned 72000 and Jill earned 80000 and they received 4000 of interest income from a joint savings account.

How much gross income would Jack report if he files married-separate from Jill. How much gross income would Jack report if he files married-filing-separate from Jill. This year Jack earned 72000 and Jill earned 80000 and they received 4000 of interest income from a joint savings account.

B94875 if they reside in a community property law state. This year Jack earned 95750 Jill earned 100500 and they received 8700 of interest income from a joint savings account. This year Jack earned 72000 Jill earned 80000 and they received 4000 of interest income from a joint savings account.

78000 if they reside in a community property law state. Jack and Jill are married. Jack works as a surgeon earning 85000 a year.

72000 if they reside in a common law state. This year jack earned 72000 and jill earned 80000 and they received 4000 of interest income from a joint savings account. How much gross income would Jack report if he files married filing separately from Jill.

This year Jack earned 72000 and Jill earned 80000 and they received 4000 of interest income from a joint savings account. E All of these choices are correct. This year Jack earned 80200 and Jill earned 96000 and they received 9800 of interest income from a joint savings account.

This year Jack earned 72000 Jill earned 80000 and they received 4000 of interest income from a joint savings account. C Steve is taxed on 62000 of income from gifts received this year. 74000 if they reside in a community property law state.

Jack and Jill are married. This year Jack earned 72000 Jill earned 80000 and they received 4000 of interest income from a joint savings account. Jack and Jill are married.

How much gross income would Jack report if he files married filing separately from Jill in a community property law state. 84000 if they reside in a common law state. 36 Jack and Jill are married.

This year Jack earned 72000 and Jill earned 80000 and they received 4000 of interest income from a joint savings account. Jack and Jill are married. 72250 if they reside in a common law state.

A90500 if they reside in a common law state. Jack and Jill are married. This year Jack earned 72250 Jill earned 82250 and they received 11800 of interest income from a joint savings account.

Jack 888-88-9999 and Jill 051-88-9999 Baker live on 100 Hill Street Bucket CA. How much gross income would Jack report if he files married-separate from Jill. Jack and jill are married this year jack earned 72000.

Transcribed Image Text UpAHill Corporation an S corporation Income Statement December 31 year 1 and year2 Year 1 Year 2 Sales Revenue 175000 310000 Cost of Goods Sold Salary to owners Jack and Jill Employee Wages Depreciation Expense Miscellaneous Expenses Interest income Dividend Income Overall Net Income 60000 40000 15000. Jack and Jill are married. How much gross income would Jack report if he files married filing separately from Jill.

Jack and Jill are married. Ack and Jill are married. This year Jack earned 90500 Jill earned 99250 and they received 12200 of interest income from a joint savings account.

This preview shows page 62 - 65 out of 195 pages. They have one son Michael 007-00-2016 who is 5. How much gross income would jack report if he files married-filing-separate from jill.

D Dave may deduct the 62000 received by Steve. Accounting questions and answers. Jack and Jill are married.

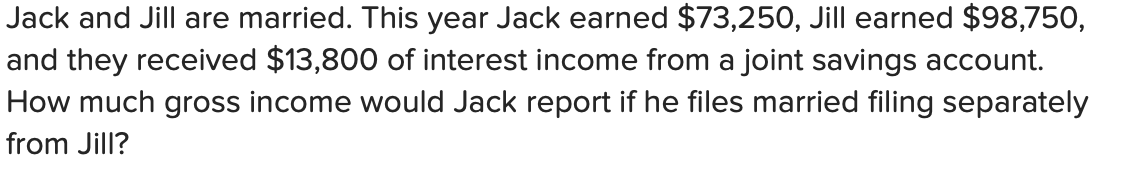

This year Jack earned 72250 and Jill earned 82250 and they received 11800 of interest income from a joint savings account. 76000 if they reside in a. This year Jack earned 73250 Jill earned 98750 and they received 13800 of interest income from a joint savings account.

How much gross income would Jack report if he files married-filing-separate from Jill. But it would be included in his gross income next year when the credit becomes a valuable right. How much gross income would Jack report if he files married-filing-separate from Jill.

How much gross income would Jack report if he files married-filing-separate from Jill. How much gross income would Jack report if he files married filing separately from Jill. 72000 if they reside in a common law state.

This year Jack earned 72000 and Jill earned 80000 and they received 4000 of erest income from a joint savings account. Jack and Jill are married. Jack and Jill are married.

Jack and Jill are marrmed. This year Jack eamed 79500 and Jill earned 84000 and they receved 9400 of Interest income from a joit savings account How much gross income would Jack report if he files marned-fitng-separate from JIP Multiple Choice 86450 If they reside in a community property lew state 79500 f they reside in a. This year Jack earned 72000 and Jill earned 80000 and they received 4000 of interest income from a joint savings account.

76 Jack and Jill are married.

15 Best Wedding Ideas For A Jack And Jill Couples Shower Couples Wedding Shower Themes Wedding Shower Themes Couples Bridal Shower

Solved Question 13 Mandatory 3 34 Points Jack And Jill Chegg Com

Solved Jack And Jill Are Married This Year Jack Earned Chegg Com

The Best Episodes Of Jack Jill Episode Ninja

:max_bytes(150000):strip_icc()/Jack-and-jill-party-4843538_final_rev_02-6e80293f5d374aed99f069857abe107f.png)

How To Plan A Jack And Jill Party Tips And Etiquette

Jack And Jill Halloween Costume Contest At Costume Works Com Homemade Halloween Cool Couple Halloween Costumes Halloween Costume Contest

Jack Norman Biohazard Clan Master Rerevelations Personagens Herois

Jack Jill By Kealan Patrick Burke

Hosting A Jack And Jill Party 6 Do S And Don Ts Weddingdresses

Jack And Sally Wedding Cake Topper By Yourpersonalengraver On Etsy 56 00 Nightmare Before Christmas Wedding Wedding Cake Toppers Disney World Wedding

Jack And Jill Are Married This Year Jack Earned Chegg Com

Gremlins Cookies Gremlins Galletas

Women On Film The Scandalous Life Of An Unmarried Woman Unmarried Women Jill Clayburgh Actresses

Christopher Mcdonald Mcdonald Robert Redford Christopher

Bookmark This How To Calculate The Amount Of Booze Needed For Your Next Party Wedding Party Planning Wedding Drink Booze

2018 Associates Newsletter By Jack And Jill Of America Inc Issuu

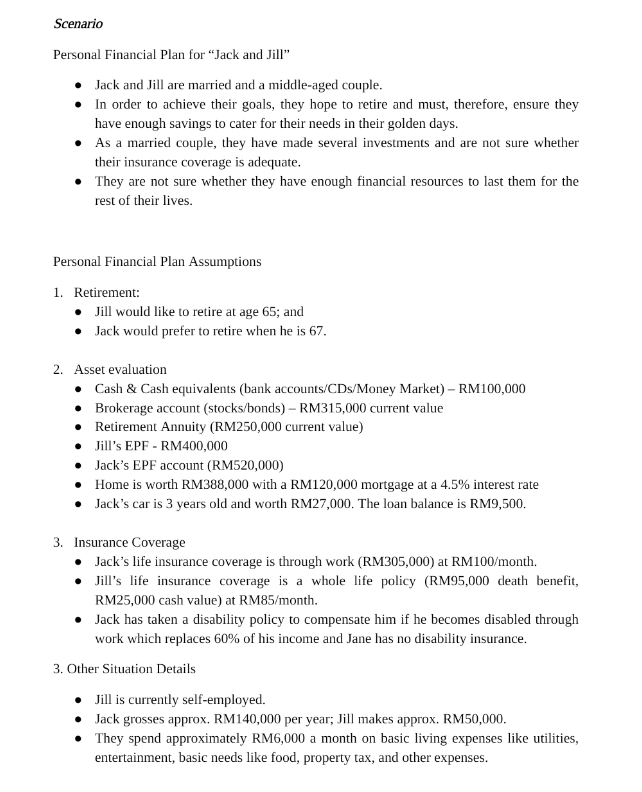

Scenario Personal Financial Plan For Jack And Jill Chegg Com

Comments

Post a Comment